S&P Global (SPGI)·Q4 2025 Earnings Summary

S&P Global Q4 2025 Earnings: Revenue Beat, Guidance Disappoints

February 10, 2026 · by Fintool AI Agent

S&P Global delivered a strong fourth quarter with revenue up 9% and adjusted EPS up 14%, but shares fell 11% in after-hours trading after management guided 2026 earnings below Wall Street expectations. The data and analytics giant reported adjusted EPS of $4.30, beating the $3.77 delivered a year ago, while guiding to $19.40-$19.65 for 2026 versus Street consensus of $19.96.

CEO Martina Cheung highlighted the company's execution and AI integration progress: "We delivered a strong quarter driven by performance in all divisions, momentum in private markets, and expansion with our CCO clients... The scale of innovation and pace of AI integration in our products and internal processes was a leap forward for our clients and the business."

Did S&P Global Beat Earnings?

Q4 2025 was solid across the board — the disappointment is entirely about forward guidance.

Full-Year 2025 Performance:

The company achieved its 53rd consecutive year of dividend increases, raising the quarterly payout to $0.97 per share.

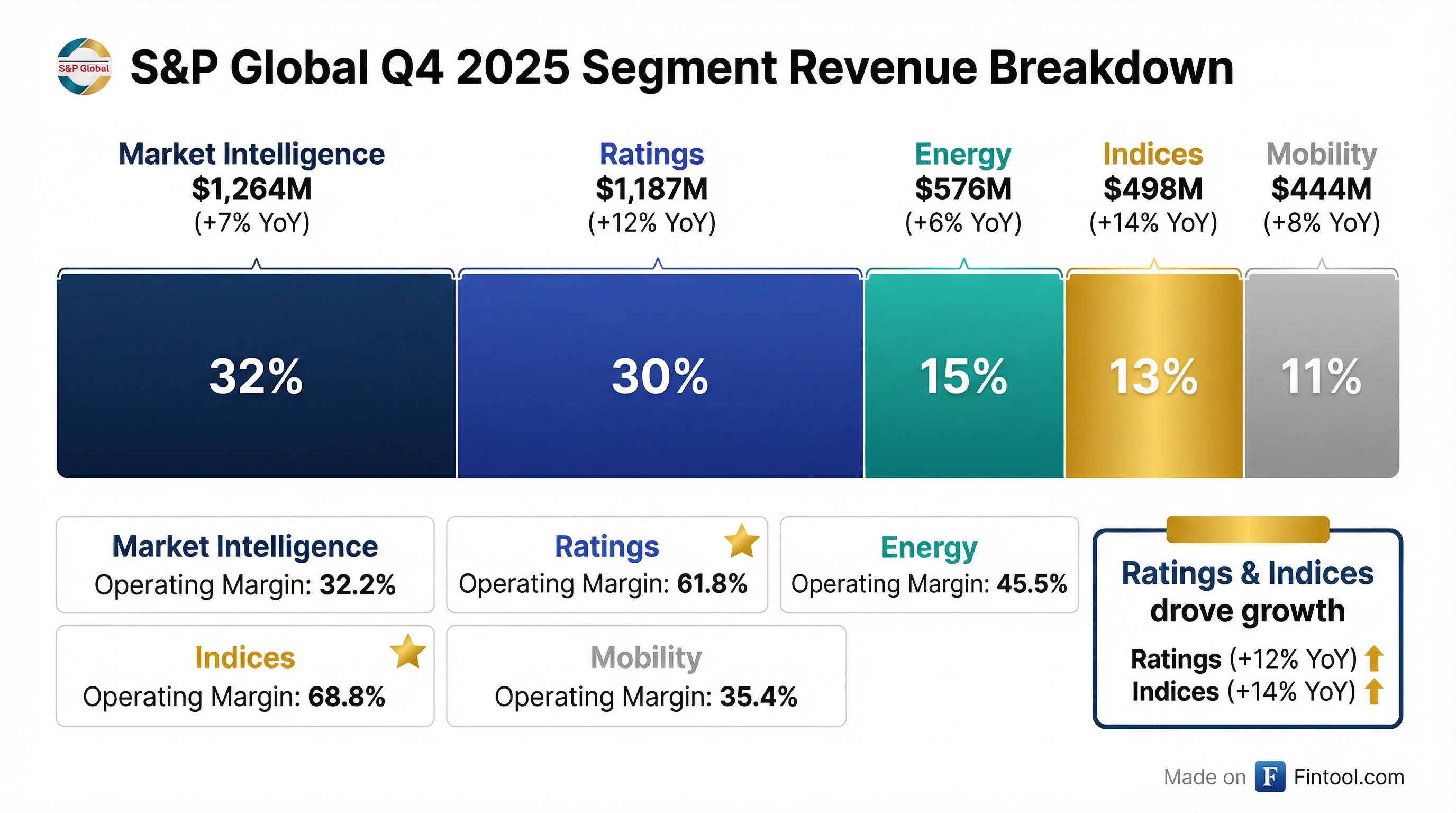

How Did Each Segment Perform?

Ratings and Indices were the stars, both posting double-digit growth with industry-leading margins.

Key segment highlights:

-

Ratings (+12%): Driven by a 28% increase in billed issuance. U.S. investment-grade issuance surged 83%, high-yield up 49%. Global high-yield and leveraged loan markets remained active.

-

Indices (+14%): ETF AUM linked to S&P DJI indices reached $5.48 trillion, up 25% YoY. Net inflows of $197B in Q4 plus $111B in price appreciation. Exchange-traded derivatives volumes strong.

-

Market Intelligence (+7%): Benefited from With Intelligence acquisition (November 2025). 96.4% recurring revenue, though non-subscription and volume-driven products slowed.

-

Mobility (+8%): CARFAX and automotiveMastermind drove Dealer growth. Double-digit growth in Financials & Other offset by softness in Manufacturing consulting. Spin-off expected mid-2026.

-

Energy (+6%): Strong subscription growth in Energy & Resources Data & Insights and Price Assessments. Advisory & Transactional Services declined. Government sanctions impacted select customers.

What Did Management Guide For 2026?

The guidance gap is the story. Management's 2026 EPS outlook came in ~2% below consensus, spooking investors despite solid Q4 execution.

*Values retrieved from S&P Global

Division-level 2026 guidance:

Key guidance assumptions:

- Ratings: Bond issuance up low to mid-single digits; base case assumes 2026 refinancing comes to market without massive pull-forward from 2027-2028

- Indices: Equity market appreciation of 5%-7% from Jan 1 to Dec 31; low single-digit ETD volume growth

- Energy: ~60 bps headwind from sanctions through Q3 2026

- Market Intelligence: Subscription growth in top half of guidance; prudent on volume-driven products

Guidance assumes full-year Mobility contribution and excludes stranded costs from the planned spin-off. GAAP guidance will be provided upon Mobility separation completion.

How Did the Stock React?

SPGI dropped ~7% on earnings day after falling ~11% in after-hours trading the night before. The stock opened at $418.97, hit an intraday low of $395.88 (a new 52-week low), and closed at $411.96.

*Values retrieved from S&P Global

Context matters: SPGI had traded near $470 just a week before earnings. The stock was already down ~6% heading into the print, suggesting some concern was already priced in. The post-earnings selloff brings the stock to new 52-week lows and down ~29% from its 52-week high.

What Changed From Last Quarter?

Q3 2025 → Q4 2025 shifts:

*Values retrieved from S&P Global

Key changes to monitor:

-

OSTTRA JV Impact: Operating profit from OSTTRA JV dropped to essentially zero in Q4 vs $26M in Q4 2024 — this will affect year-over-year comparisons going forward.

-

Mobility Spin Approaching: The company reiterated mid-2026 timing for the Mobility spin-off. The new standalone company will be named "Mobility Global." Matt Hoisch named CFO designate. Guidance excludes any stranded cost impact.

-

With Intelligence Acquisition: The November 2025 acquisition added ~70 bps to Market Intelligence revenue growth organically but pressured margins. Integration moving fast: 75% of combined fund manager and investor datasets linked in less than a month using Kensho Link, SSO through Capital IQ Pro enabled in January, and 200+ new sales leads and cross-sell opportunities generated in the first 60 days post-close.

-

Issuance Environment: Global rated issuance remained robust. Billed issuance increased 11% for the full year, surpassing $4.3 trillion. The 2026 maturity wall is 12% higher than 2025's wall was a year ago.

-

Enterprise Efficiency Gains: The Chief Client Office (CCO) and Enterprise Data Office (EDO) delivered in their first full year. EDO eliminated more than 10% of applications and reduced manual data processing meaningfully, with more than half of total data workflows now processed via automation tools. On track to reduce run-rate expenses by 20%+ by 2027.

-

ACV Acceleration: Market Intelligence ACV growth accelerated to 6.5%-7% in Q4, up from 6%-6.5% in the first half of the year.

Capital Allocation Priorities

S&P Global returned 113% of adjusted free cash flow to shareholders in 2025 — a clear signal of management confidence.

2026 priorities:

- Maintain 85%+ FCF return to shareholders

- 53rd consecutive year of dividend increases — quarterly dividend now $0.97

- Continued share count reduction (diluted shares down 2% YoY)

Balance Sheet & Leverage

The balance sheet remains healthy with leverage well within investment-grade parameters. The company issued $993M in senior notes during 2025 while paying down minimal debt.

What Did Analysts Ask About?

Q&A Highlights from the Earnings Call:

On AI Competition and Workflow Moat

Analyst Faiza Alwi (Deutsche Bank) pressed on whether AI shifts could threaten S&P Global's workflow products. CEO Martina Cheung pushed back firmly:

"The workflow tools that S&P Global has developed are critical systems of record for our customers... They're not simple apps that were developed rapidly. These are enterprise-grade solutions that involve sophisticated integration. Many of them provide connectivity across industry networks of clients, and they enable capital flows, trading, reporting, and other mission-critical functions."

She emphasized that regulated environments require compliance, risk management, and data integration that AI-native startups can't easily replicate. One CCO client told the company: "We've seen some of the bigger tech firms. We're also looking at some of these niche providers that have AI-native shells without the data, and frankly, we prefer to work with you guys."

On Ratings Guidance Below Long-Term Framework

Toni Caplan (Morgan Stanley) questioned why Ratings guidance of 4%-7% was below the long-term framework despite positive tailwinds. Cheung explained three key assumptions:

- No massive pull-forward from 2027-2028 maturity walls — many were issued at very low rates

- Modest M&A growth year-over-year — timing of announced deals remains uncertain

- Hyperscaler issuance — conservative on debt funding despite $650B in announced CapEx

She noted potential upside: "If we saw higher levels of hyperscale issuance throughout the course of the year than we saw in 2025, we think that could possibly add a few percentage points to build issuance."

On Market Intelligence Volume Softness

Eric Aboaf (CFO) addressed the slowdown in volume-driven products, noting it was market-driven, not competitive:

"There are no cancellations, there's no questions around pricing. It's all been the variability in some of those external market factors."

Specific factors included lower bank loan syndications affecting ClearPar, softer equity issuances, and variable muni activity. With 85% of MI in subscriptions, he characterized this as normal quarter-to-quarter variability.

On AI Revenue Contribution

Craig Huber (Huber Research) asked directly about AI's revenue impact. Cheung declined to quantify but highlighted tangible traction:

- iLevel automated data ingestion: ~20% of customers adopted within 6 months (paid add-on)

- Microsoft Copilot add-on for Energy customers: robust pipeline

- Competitive wins: AI-enabled capabilities helping win against competitors

She stated: "We would certainly expect over the next several years that revenue growth will outstrip headcount growth."

On Capital Allocation

Andrew Nicholas (William Blair) asked about prioritizing buybacks vs. M&A. Cheung was unequivocal: "We don't have any appetite for transformational M&A. We're always gonna be very disciplined."

CFO Aboaf noted they're planning ~$1B in buybacks for Q1 2026 (vs $650M last Q1) given current stock levels.

What to Watch Going Forward

Key catalysts:

-

Mobility Spin-Off (Mid-2026): The standalone company will be named "Mobility Global." Key milestones in Q2 2026: public Form 10 filing, Mobility Investor Day, equity roadshow, and public debt offering targeting an Investment Grade rating. Watch for stranded cost estimates and standalone margin profiles.

-

Issuance Trends: Ratings revenue is highly sensitive to debt capital markets activity. The strong 2025 issuance environment may moderate if rates stay elevated.

-

AI Integration: Management highlighted "leap forward" in AI integration across products. Recent announcements include: MCP connector for OpenAI, partnership with Google for Gemini Enterprise (December 2025), and expanded work with Anthropic through Claude for Financial Services. S&P Global is a leading provider of financial data through Claude. Also entering DeFi: S&P 500 Index on-chain with Centrifuge, Stablecoin Stability Assessments. Management's stance: "We see AI really as a net tailwind for the business."

-

ETF Flows: Indices revenue depends on AUM levels. A market correction would pressure asset-linked fees. Guidance assumes 5%-7% market appreciation.

-

Private Markets Momentum: Private markets revenue grew 16% YoY in Q4, driven primarily by Ratings (private credit analysis, credit estimates) and Market Intelligence (With Intelligence, Cambridge-Mercer partnership). The team is working on new index opportunities using combined data from With Intelligence and Cambridge-Mercer. Beta for Cambridge-Mercer launched in Q4 with positive feedback.

-

Decentralized Finance (DeFi): Management called out DeFi as a strategic focus area. Already launched S&P 500 on-chain with Centrifuge and stablecoin stability assessments. CEO Cheung: "We'll have more to share in this exciting area in the quarters to come." First protocol rating completed in Q3 2025.

The Bottom Line

S&P Global delivered exactly what investors expected in Q4 — strong execution across all five segments with Ratings and Indices leading the way. The problem is what comes next. Management's 2026 EPS guidance of $19.40-$19.65 came in ~2% below Street consensus, and that was enough to trigger an 11% after-hours selloff.

The fundamentals remain solid: 50%+ adjusted operating margins, 113% of free cash flow returned to shareholders, and exposure to secular tailwinds in passive investing, debt markets, and energy transition data. But at current levels, the stock is pricing in more growth than management is willing to promise — especially with the Mobility spin-off adding execution uncertainty.

What matters now:

- Whether the 2026 guide proves conservative (as prior years have been)

- Mobility spin timing and stranded cost impact

- Durability of the 2025 issuance boom

- AI product traction and competitive positioning

Data as of February 10, 2026. Sources: S&P Global Q4 2025 8-K filing, earnings presentation, and company press releases.